Imagine the nitrogen cycle is a trust fund kid with a gambling problem.

The young man (a corn field) is very rich (has rich black soil) but the money (nitrogen) he inherited from his father (the prairie) is locked in a trust fund (soil organic matter). Only a small portion of the funds are released to him each year (mineralized) following a complicated schedule determined by the trustees (microbes in the soil). In order to maintain the lifestyle to which he has become accustomed (provide enough nitrogen to the crop for good yields), he needs supplemental income (nitrogen from commercial fertilizer or manure). His sister (a soybean field) does not need to work (apply fertilizer) because she can borrow money from her well-connected husband (symbiotic nitrogen-fixing bacteria) but she also receives payments from the trust (mineralization). She helps her brother out (corn needs less nitrogen fertilizer following soybeans) but not directly (soybeans actually use more nitrogen than they fix, so the benefits of the rotation has more to do with the behavior of the residue and disrupting corn pests).

Both siblings have a gambling (water quality) problem and are terrible poker players. Whenever they’re feeling flush with cash (when other forms of nitrogen have been converted to nitrate) they blow some of it playing cards (nitrate easily leaches out of the root zone when it rains), but the extent of the losses vary and debts aren’t always collected right away (nitrate leached out of the root zone may not immediately reach streams). They struggle with temptation more than their cousins (alfalfa and small grains) because they come from a broken home (the soil is fallow for large parts of the year) and because bills and income don’t arrive at the same time (there is a mismatch between the timing of maximum nitrogen and water availability and crop nitrogen and water use).

“”Okay, Dan, that’s very clever, but what’s your point?

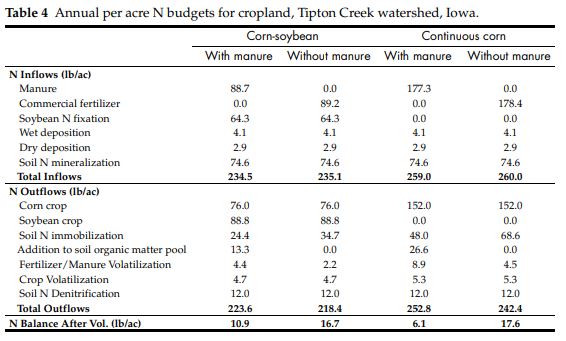

Well, having compared the soil to a trust fund, I can now say “don’t confuse net worth with income.” You’ve probably heard that there 10,000 pounds per acre of nitrogen stored in a rich Iowa soil. That’s true but misleading. The amount actually released each year by decomposing organic matter (net mineralization) is only a few percent of that, comparable in size and importance to fertilizer or manure. Here’s an example nitrogen budget.

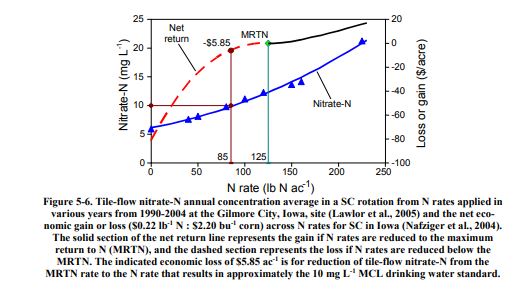

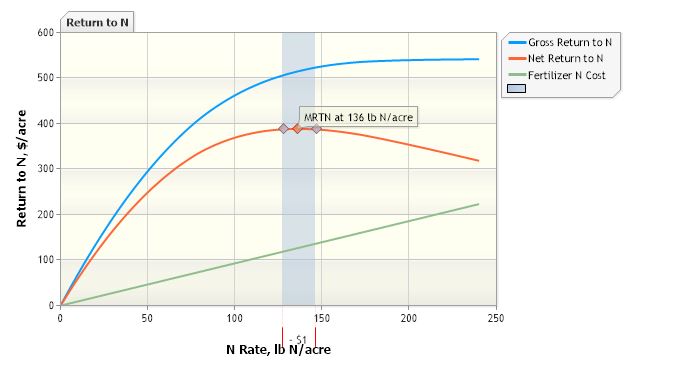

On average and over the long-term, we know that fields and watersheds with higher nitrogen applications (taking into account both manure and commercial fertilizer) leach more nitrate into the water. On average and over the long-term, we know that that farmers can profit by reducing their application rate to the Maximum Return To Nitrogen (the point at which another pound of nitrogen does not produce a big enough yield bump to offset the fertilizer costs). Right now, with corn prices high but fertilizer prices going nuts, the MRTN is 136 pounds per acre for corn following soybeans, while in the most recent survey I could find, farmers reported applying an average of 172 pounds per acre. So there’s room to save money while improving water quality!

But having compared nitrate leaching to gambling, I can also say “don’t confuse a balance sheet problem with a cash flow problem.” In any given year, it’s always a gamble how much of the nitrogen that’s applied will be washed away and how much will be available to the crop. Maybe some farmers are passing up on an opportunity to increase their profits because they’re not comfortable with the short-term risks.

Farmers say that extra nitrogen is cheap insurance. If that’s true, maybe we need crop insurance that makes it easier to do the right thing, not a more precise calculator.